Not having health insurance coverage is a danger, not only for the conservation of your health, however also your financial security. 1. You buy vehicle insurance coverage since it helps you spend for repair work if it breaks down or you have a mishap. Medical insurance is a.

little.

like that. Health insurance helps you spend for medical professionals, health centers, medications and more if you get ill or have a mishap. What's more, health insurance assists you spend for preventive care, like annual vaccinations, examine ups and wellness programs, so you're less most likely to become ill. You and your medical insurance business become" partners" who work together to pay for your health care. This is referred to as. Your payment is called an In some cases, your employer pays part of the regular monthly and you pay part. Health Plans with a Copay+ Deductible +Coinsurance 2. Health Plans with a Deductible+ Coinsurance( No Copay), Normally, copays are for physician's workplace, immediate care and emergency situation space gos to, and prescription drugs. But read your health plan information to be sure.( Copays do not count towards paying your deductible.) You'll spend for any services or materials not covered by a copay, when you have a look at, until you have actually satisfied your deductible for the plan year. After you meet your deductible, then you pay part of the bill (say 20%) and your insurance pays part of the expense (state 80% )till you've paid your coinsurance for the strategy year. People typically buy a plan with copays so they have a better concept of the expense of each check out before they go. Plans with copays can be more costly, however are a good option if you understand you'll need to go to the physician a lot. You'll spend for any services or materials, when.

you take a look at, till you have actually fulfilled your deductible for the plan year. After you satisfy your deductible, then you pay part of the expense( say 20%) and your insurance coverage pays part of the expense (state 80 %) until you've paid your coinsurance for the strategy year. (Together, this is the most you'll pay during the plan year.) up until the strategy year ends or you alter insurance coverage strategies. This is a good choice if you're relatively healthy and don't need to visit the physician a lot. Medical professionals don't typically get the full expense of their services. Your insurance negotiates a lower rate for you from your physician. What does homeowners insurance cover. The physician joins your insurance coverage company.

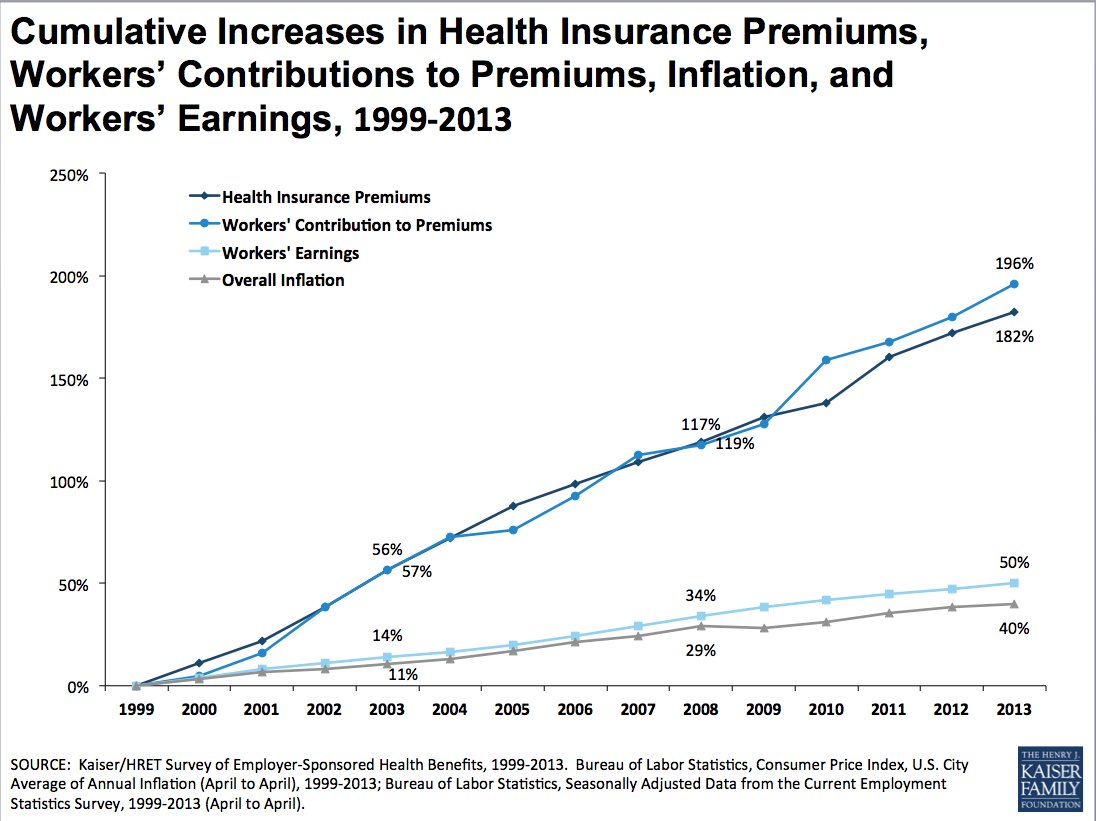

's of health care providers and accepts charge less so you pay less. This is called being If you pick a medical professional who is, and not a partner with your insurer, you might have to pay part or all of the costs yourself. Your insurance coverage and the medical professional have actually consented to a set cost for the health services you get - How much car insurance do i need. This is a chart that reveals the amount: your physician billed you your insurance coverage permits the medical professional to bill you your insurance paid the physician you conserved you owe if you have not paid your deductible or coinsurance How to Read Your EOB world financial group el paso All health plans are not the same! Your strategy may be extremely various from what we're showing here. Before you buy a plan, be sure to read all the information about your expense sharing responsibilities and speak to an insurance expert to read more. In the past, the majority of people had company health insurance coverage. Their company did all of the research, selected the insurance coverage company and chose plan alternatives for staff members. This is likewise called group coverage or group insurance coverage. However, a lot has changed recently. Challenging financial times have required many companies to cut expenses. Increasing health care costs have actually made it challenging for companies to pay for medical insurance. New and more expensive technologies, treatments and drugs have actually emerged, adding expenses. Due to these factors and others, a growing trend is for people to either partially or totally pay for their own medical insurance. To help you comprehend your choices, we'll take a look at both specific and employer-sponsored strategies, discussing and comparing them. Person Insurance is a health policy that you can buy for simply yourself or for your household. Specific policies are also called personal health strategies. If you 'd like, you can work with an insurance coverage representative to assist you review various plans and costs. You might be eligible for a.

aid from the federal government to buy an Affordable Care Act-compliant individual plan. This can conserve you money on your health insurance. You might be qualified for an aid if your employer does not use budget friendly health dianne richard coverage and your household earnings disappears than 400% above the federal poverty line. Advantages of a private strategy: You can choose the insurance business, the plan and the alternatives that meet your needs. You can restore or alter health insurance coverage plans, options and health insurance coverage business throughout the yearly Open Registration period. Your strategy is not connected to your task, so you can alter jobs without losing your protection. You can pick a plan that consists of the doctors and healthcare facilities you trust. You may be eligible for an aid from the federal government.

to help pay for your insurance. Medical Mutual offers numerous affordable individual health insurance that can meet your needs. Employer-sponsored health insurance coverage is a health policy selected and purchased by your company and provided to qualified workers and their dependents. Your employer will normally share the cost of your premium with you. Benefits http://spencerbpqw381.lucialpiazzale.com/how-much-will-my-insurance-go-up-after-an-accident-can-be-fun-for-everyone of a company plan: Your company frequently splits the expense of premiums with you. Your employer does all of the work picking the strategy options. Premium contributions from your company are not subject to federal taxes, and your contributions can be made pre-tax, which reduces your gross income. Choosing whether to enlist in a medical insurance plan through your employer or whether to acquire a specific, major medical intend on your own can be confusing. There can be significant distinctions in versatility, advantage choices and expenses. The following table summarizes some resemblances and distinctions that can assist you determine what will best fit your needs. an employer-sponsored group plan can vary depending on a number of aspects. These include your income, where you live and whether your company provides a group medical insurance plan. Below are some averages for yearly premium expenses for employer and individual strategies: Typical Yearly Premium Cost for A Single Person Individual Plan$ 4,632. 00 1 Individual Strategy with Premium Tax Credits$ 1,272. 00 1 Employer-Sponsored Plan( Company and staff member generally share this expense )$ 6,435. 00 2 While averages can offer you a concept of common expenses, the real story is typically.

The Main Principles Of What Is Insurance

more complex. In lots of states, private plans are more economical - What is collision insurance. That's because individual medical insurance spreads the threat over a large group possibly millions of individuals depending on the plan and insurance provider.